Personal Checking

Investar Bank offers many checking account options designed to fulfill a variety of financial needs for individuals and families. We have non-interest bearing, traditional household checking accounts, as well as interest bearing accounts.

Compare Accounts

eChecking

Hassle free account with no minimum balance requirement and no monthly service fee*.

- No Minimum Balance Requirement

- Unlimited Monthly Transactions

- Free Online Bill Pay

- Monthly E-Statements

- ATM or Debit Card Available

- 24 Hour Phone Banking

- *Paper statement fee $5

Advantage Checking

Take advantage of interest-bearing checking while avoiding monthly fees. To earn a higher interest rate, receive ATM fee refunds, and avoid $7 monthly service fee, all of the following qualifications must be met per one calendar month:

- Enroll to receive monthly E-statements

- Make 10 debit card purchases

- Maintain at least one ACH or direct deposit

- ATM fee refunds up to $30 per cycle when the above qualifications are met

Other account perks:

- Unlimited Monthly Transactions

- Free Online Bill Pay

- ATM or Debit Card Available

- 24 Hour Phone Banking

Interest Checking

Earn a competitive interest rate with unlimited transactions.

- $1,500 Minimum Daily Balance to avoid Monthly Service Fee

- $10.00 Monthly Service Fee if balance falls below $1,500

- Unlimited Monthly Transactions

- Free Online Bill Pay

- Monthly E-Statements with Images

- ATM or Debit Card Available

- 24 Hour Phone Banking

- Paper Statement fee $5

Senior Select

A full-service, interest bearing checking account for customers age 55 and older.

- $500 Minimum Daily Balance to avoid Monthly Service Fee

- $5.00 Monthly Service Fee if Balance falls below $500

- Unlimited Monthly Transactions

- Free Online Bill Pay

- Free Bank Stock Checks

- 10% Discount on Safe Deposit Box Rental

- Free Cashier’s Checks and Money Orders

- ATM or Debit Card Available

- 24 Hour Phone Banking

- Paper Statement fee $5

All Accounts Include:

Online/Mobile Banking

Access your accounts 24/7 from your phone or computer

24/7 Telephone Banking

To access your accounts

by phone, call 1-866-602-3621

Zelle Digital Payments

Send and receive money directly through the Investar app or online banking

Monthly E-Statements

All accounts receive free monthly e-statements. Paper statements are $5/month

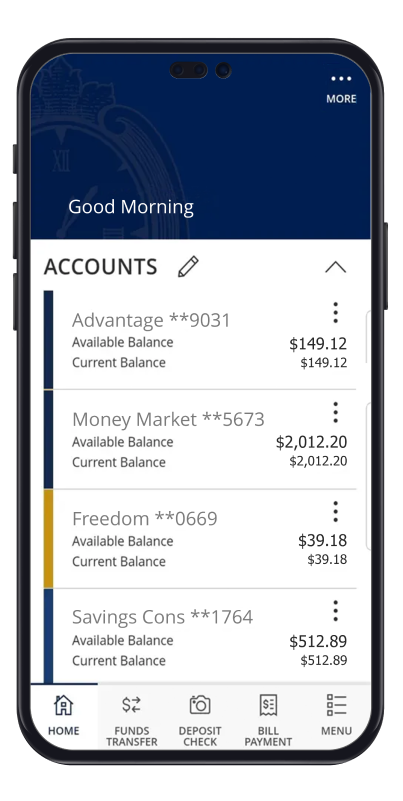

Bank Anytime, Anywhere. Get the Investar App!

With the Investar Bank mobile banking app, you can access your accounts anytime, anywhere from your mobile device(s). The mobile app allows quick and secure access to:

- View your account balance

- View account activity and deposit history

- Transfer money between accounts

- Send money to friends and family with Pop Money

- Deposit checks by snapping a picture of each check

- Locate a Branch or ATM

Explore More Personal Banking Products

Savings, CDs, & IRAs

Explore and compare savings and investment options to help you reach your financial goals.

Consumer Loans

Learn about checking account options designed to fulfill a variety of financial needs for individuals and families.

Mortgages

Take a look at our available mortgage products and see why we’re the best choice for your mortgage needs.