Business Accounts

Compare Accounts

Regular Business Checking

- $200 Minimum Opening Deposit

- $500 Minimum Daily Balance to avoid Monthly Service Fee $7.00

- Unlimited Monthly Transactions

- Business Debit Card Available

Interest Business Checking

- $1500 Minimum Opening Deposit

- Interest Bearing Account

- $1500 Minimum Daily Balance to avoid Monthly Service Fee $10.00

- Unlimited Monthly Transactions

- Business Debit Card Available

Commercial Account Analysis

This is an analyzed account that calculates a monthly service charge based on account activity and assigns an earnings credit based on the available balance. The earnings credit is used to offset the transaction fees.

- Business Debit Card Available

Regular Business Savings

- $100 Minimum Opening Deposit

- Interest Bearing Account

- $100 Minimum Daily Balance to avoid Monthly Service Fee $5.00

- Up to 6 Free Withdrawals Monthly

($4 per withdrawal thereafter)

Business Money Market

- $2,500 Minimum Opening Deposit

- $2,500 Minimum Daily Balance to avoid Monthly Service Fee $12.00

- Up to 6 Free Withdrawals Monthly

($10 per withdrawal thereafter)

Business Money Market Plus

- $10,000 Minimum Opening Deposit

- $10,000 Minimum Daily Balance to avoid Monthly Service Fee $15

- Up to 6 Free Withdrawals Monthly

($10 per withdrawal thereafter)

IOLTA Account

- $200 Minimum Opening Deposit

- Interest Bearing Account

- No Monthly Service Fee

- Monthly E-Statements with Images

Business CDs

- Maturities ranging from 30 days to 60 months

- Minimum deposit to open a CD is $500.00. Interest can be added back to principal, paid directly by check to you, or deposited into another FNB account

Accounts Include:

Online/Mobile Banking

Access your accounts 24/7 from your phone or computer

24/7 Telephone Banking

To access your accounts

by phone, call 1-866-602-3621

Zelle Digital Payments

Send and receive money directly through the FNB app or online banking

Monthly E-Statements

All accounts receive free monthly e-statements. Paper statements are $5/month

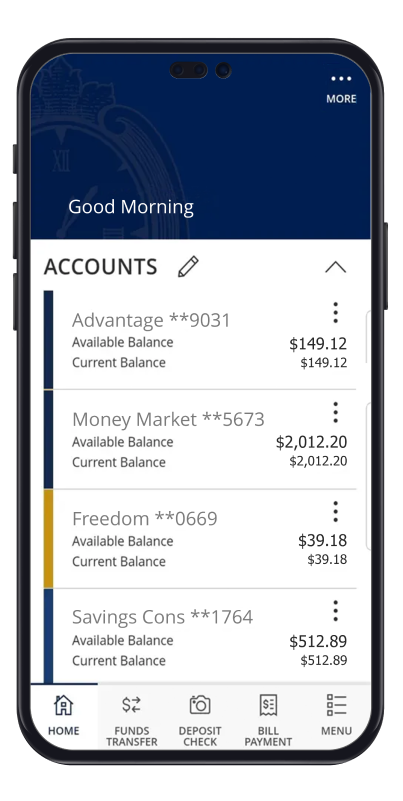

Bank Anytime, Anywhere. Get the FNB App!

With the First National Bank mobile banking app, you can access your accounts anytime, anywhere from your mobile device(s). The mobile app allows quick and secure access to:

- View your account balance

- View account activity and deposit history

- Transfer money between accounts

- Send money to friends and family with Pop Money

- Deposit checks by snapping a picture of each check

- Locate a Branch or ATM

Explore More Business Banking Products

Business Solutions

Our business services can help you effectively manage your money and get you back to growing your business.

Business Lending

First National Bank offers a wide range of options for short-term, seasonal and long-term borrowing needs.

Government Leasing

Lease financing for cities, counties, government agencies, hospital districts and school districts.